New Year…New Real Estate?

Looking back at last winter to see what the holidays and a fresh start in 2024 mean to the real estate market today.

Many people think of winter as a quiet time for real estate and in many ways this is true. The end of the year can sometimes serve as an invisible deadline for a home search, or pulling a home off the market until the spring.

But if we look at the numbers, it seems like the epidemic of low inventory and rising interest rates has made the winter months an interesting time for buyers and seller alike.

When we look at new listing data - i.e. the number of homes added to the market in a given month in NY - we see that last winter, December was low, which makes sense with the holidays and travel. But the number shoots up to 9,743 in January of this year and increases even more in February with 9,905 new listings . For context, the month in 2023 with the largest number of new listings was May with 15,540.

Source: NYSAR

So we can expect that inventory should rebound fairly strongly in the New Year. However, inventory in general has decreased year over year for the past two years so we can also expect a less robust increase than last year, especially with the dramatic increases in interest rates. While 2024 might bring some relief for buyers in terms of interest rates, rate changes are unlikely to be dramatic enough to really shake things up for buyers or sellers. Interest rates peaked in October at 7.79% on a 30-year fixed-rate mortgage, according to Freddie Mac. This is up from the 7.20 average in September. In October of 2022, the average on a 30-year fixed-rate mortgage was 7.08 percent.

If you, like so many buyers have questions about interest rates right now, we could not recommend enough getting on the phone with a reliable and knowledgeable lender. We have several that we recommend to our clients that have proven themselves absolutely essential time and time again to this process.

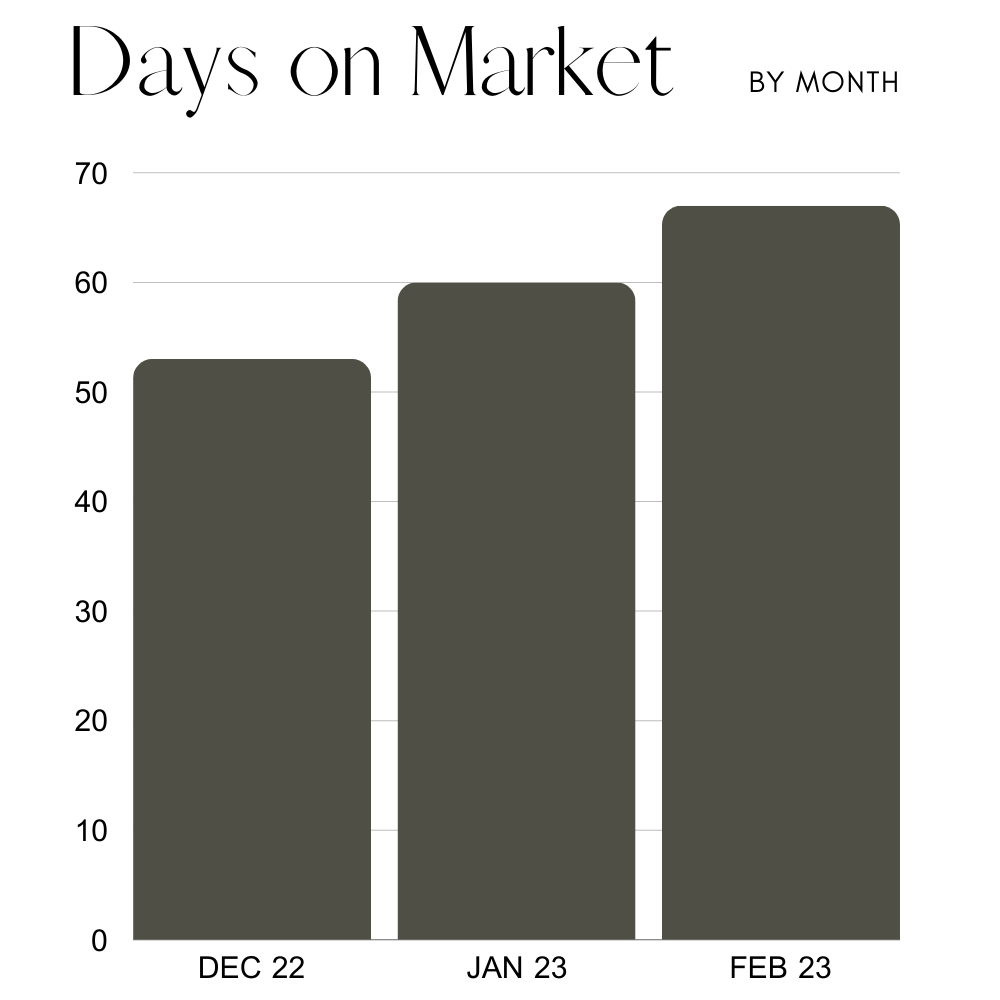

Another metric we can look at is the number of days a listing sits on the market. In December of last year that number dropped, perhaps because of a rush to close out business before the holidays, but also because of the lull in inventory that December brings. When homes are sitting longer on the market it can translate to more inventory, more competition for sellers. The data does seem to show a sweet spot in January, when inventory is slowly creeping up and buyers are emerging to see whats new. Furthermore, buyers shopping in January tend to be pretty serious and motivated. Perhaps some of them have made a New Year’s resolution to finally find their dream home and they’re willing to bundle up and maybe even shovel some snow to make it happen!

We like to imagine this timeline works out for buyers that came up to the Hudson Valley over the summer and fell in love, took a month or two to decide to move, and another few months of casual searching and getting their pre-approval in order.

Source: NYSAR

Source: NYSAR

Another supportive piece of data for January being the secret underdog of real estate months is the number of closed sales per month. December of 2022 closings were up to 9,758 and then fell in January and really came down in February. January offers an opportunity to capitalize on whatever is left from the December boom. For sellers, that means capturing all the buyers interested in starting their search after the holidays and timing your listing correctly so it’s not lost in the inventory boom post holidays. If you’re a buyer, that means being ready to buy in early January, when inventory is starting to emerge and anything that has lingered on the market from last year has matured on the market, creating opportunities for negotiation.

If you’re a buyer looking to make a purchase in 2024, the most important thing is being prepared. Reaching out to a lender to discuss financing options is a good place to start. It’s also a good idea to connect with a realtor and find out more about your specific real estate needs.

The bottom line is, inventory is poised to be even lower this year than last year, and interest rates aren’t showing any indication that they will return to pre-2020 levels soon. Despite that, the draw to the Hudson Valley is stronger than ever, so turnkey homes, and listings with something special are going to go quickly. There are fewer homes on the market during the winter months, so when something comes along that’s a good fit you will need to be in a position to act quickly. It’s best to have already established a relationship with a realtor and a lender. In the early stages of a home search, we recommend that buyers spend as much time in the area as possible. Try Airbnbs in different towns, drive past homes that are for sale, etc. All of this will help you clarify your needs. As always, reach out to hello@upstatedown with any questions and fill out our buyer questionnaire here to get started on your home search with us.